Commission to strengthen anti-subsidies measures by end of year

15/03/2019 12:00

The European Commission will propose by the end of 2019 new measures to address the negative impact of foreign subsidies and state-owned companies, according to documents made available on Wednesday (13 March), as the EU aims for a more assertive tone towards China.

The set of proposals will be part of a review of the competition rules. A large majority of member states called for changes in order to better take into account the growing pressure of global companies.

But the Commission disagrees with the Franco-German demand for weakening antitrust rules to facilitate the creation of ‘European champions’. Instead, the EU executive will bolster its tools to address unfair practices by global rivals.

The new plans were announced in the wake of the Commission’s reconsideration of its bilateral relations with China.

Last year, the EU saw Beijing as an ally on a number of issues including climate change versus the erratic decisions of US President Donald Trump.

On Tuesday, the EU executive labelled China as a “systemic rival” and called on Beijing to work for more “balanced and reciprocal conditions” in economic relations, said Commission Vice-President Jyrki Katainen

The Commission admits that its Trade Defence Instruments are insufficient to address the challenges posed by China and other rivals.

These tools “do not cover all potential effects of unfair subsidies or support by third countries”, a Commission paper reads.

The institution has recently started assessing all EU instruments to detect existing “gaps” in the EU toolbox, an EU official said. The goal is to identify, by the end of this year, how to fill these gaps.

“This is a very important debate,” the official added.

The Commission wants to deal with the “distortive effects” of foreign state-owned companies and public financing of companies in the internal market.

The current trade defence measures only address subsidies that affect the price of products imported into the EU.

Procurement

In order to level the playing field at the global level, the Commission also urged the European Parliament and the member states to agree on the International Procurement Instrument by the end of this year.

This proposal would increase the EU’s leverage for negotiating market access with third countries. The restrictions foreign companies face in China are one of the longstanding complaints’ made by the Europeans and the US.

Meanwhile, Chinese investments in Europe have increased in recent years, particularly in key sectors such as energy, logistics or technology.

In a report published on Wednesday, the EU executive indicated that China’s recent acquisitions stand out among “new investors”

Still, China, Hong Kong and Macao only controlled 9.5% of non-EU owned companies, in 2016, compared with 29% of US and Canada. It represented 3% of non-EU controlled assets, compared with 61% owned by the US and Canada.

Responding to the growing concerns about the takeovers of foreign actors in European strategic sectors, especially by Chinese and Russian firms, the EU adopted this month new rules to strengthen the screening of foreign investment.

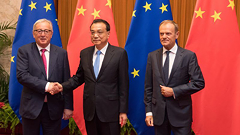

A more balanced economic relationship will be part of the EU-China summit to be held in early April.

The Commission is also concerned about the Chinese law that forces local companies to cooperate with intelligence services, and it is expected to be discussed during the summit.

A spokesperson of the Chinese mission emphasised that “cooperation between China and the EU, which is mutually beneficial, serves the interests of both sides.”

“It is our hope that the EU could view China’s development and fresh efforts to promote reform and opening-up in an objective, reasonable and fair light, and join forces with China for a sustained, healthy and steady growth of China-EU relations,” the Chinese official added.

Competition revision

In addition to new anti-subsidies measures, the Commission wants to consider in its review of the competition framework other issues related to the digital sector.

For example, how the monopolisation of data could harm innovation or whether the acquisition of startups by tech giants damages competition in the long run.

The EU executive will also ponder new ideas to strengthen European industries in strategic sectors, especially by facilitation cross border alliances.

The Commission has already relaxed EU’s state aid rules for Important Projects of Common European Interests (IPCEIs).

Member states can jointly support these projects in all sectors, by fully financing all the costs up to the testing phase of a product.

However, EU officials ruled out a major review of EU competition rules, as Germany and France pushed for to face foreign rivals by creating European champions.

“Competition rules work very well,” an EU official said.

Merger decisions generated between €5 billion and €8.5 billion in savings for consumers, the Commission estimated.

But following Brussels’ rejection of Siemens-Alstom merger, France and Germany proposed weakening the EU executive’s powers by giving EU leaders the capacity to review the antitrust decisions.

Paris and Berlin argued that the merger of the French and German train makers was necessary to compete with China’s CRRC, the largest train firm in the world.

Competition Commissioner Margrethe Vestager said the entrance of the Chinese firm in the European market was possible “in the foreseeable future”.

Since 1990, the Commission has approved 6,504 buyouts, 439 with remedies, while it rejected just 29.

The set of proposals will be part of a review of the competition rules. A large majority of member states called for changes in order to better take into account the growing pressure of global companies.

But the Commission disagrees with the Franco-German demand for weakening antitrust rules to facilitate the creation of ‘European champions’. Instead, the EU executive will bolster its tools to address unfair practices by global rivals.

The new plans were announced in the wake of the Commission’s reconsideration of its bilateral relations with China.

Last year, the EU saw Beijing as an ally on a number of issues including climate change versus the erratic decisions of US President Donald Trump.

On Tuesday, the EU executive labelled China as a “systemic rival” and called on Beijing to work for more “balanced and reciprocal conditions” in economic relations, said Commission Vice-President Jyrki Katainen

The Commission admits that its Trade Defence Instruments are insufficient to address the challenges posed by China and other rivals.

These tools “do not cover all potential effects of unfair subsidies or support by third countries”, a Commission paper reads.

The institution has recently started assessing all EU instruments to detect existing “gaps” in the EU toolbox, an EU official said. The goal is to identify, by the end of this year, how to fill these gaps.

“This is a very important debate,” the official added.

The Commission wants to deal with the “distortive effects” of foreign state-owned companies and public financing of companies in the internal market.

The current trade defence measures only address subsidies that affect the price of products imported into the EU.

Procurement

In order to level the playing field at the global level, the Commission also urged the European Parliament and the member states to agree on the International Procurement Instrument by the end of this year.

This proposal would increase the EU’s leverage for negotiating market access with third countries. The restrictions foreign companies face in China are one of the longstanding complaints’ made by the Europeans and the US.

Meanwhile, Chinese investments in Europe have increased in recent years, particularly in key sectors such as energy, logistics or technology.

In a report published on Wednesday, the EU executive indicated that China’s recent acquisitions stand out among “new investors”

Still, China, Hong Kong and Macao only controlled 9.5% of non-EU owned companies, in 2016, compared with 29% of US and Canada. It represented 3% of non-EU controlled assets, compared with 61% owned by the US and Canada.

Responding to the growing concerns about the takeovers of foreign actors in European strategic sectors, especially by Chinese and Russian firms, the EU adopted this month new rules to strengthen the screening of foreign investment.

A more balanced economic relationship will be part of the EU-China summit to be held in early April.

The Commission is also concerned about the Chinese law that forces local companies to cooperate with intelligence services, and it is expected to be discussed during the summit.

A spokesperson of the Chinese mission emphasised that “cooperation between China and the EU, which is mutually beneficial, serves the interests of both sides.”

“It is our hope that the EU could view China’s development and fresh efforts to promote reform and opening-up in an objective, reasonable and fair light, and join forces with China for a sustained, healthy and steady growth of China-EU relations,” the Chinese official added.

Competition revision

In addition to new anti-subsidies measures, the Commission wants to consider in its review of the competition framework other issues related to the digital sector.

For example, how the monopolisation of data could harm innovation or whether the acquisition of startups by tech giants damages competition in the long run.

The EU executive will also ponder new ideas to strengthen European industries in strategic sectors, especially by facilitation cross border alliances.

The Commission has already relaxed EU’s state aid rules for Important Projects of Common European Interests (IPCEIs).

Member states can jointly support these projects in all sectors, by fully financing all the costs up to the testing phase of a product.

However, EU officials ruled out a major review of EU competition rules, as Germany and France pushed for to face foreign rivals by creating European champions.

“Competition rules work very well,” an EU official said.

Merger decisions generated between €5 billion and €8.5 billion in savings for consumers, the Commission estimated.

But following Brussels’ rejection of Siemens-Alstom merger, France and Germany proposed weakening the EU executive’s powers by giving EU leaders the capacity to review the antitrust decisions.

Paris and Berlin argued that the merger of the French and German train makers was necessary to compete with China’s CRRC, the largest train firm in the world.

Competition Commissioner Margrethe Vestager said the entrance of the Chinese firm in the European market was possible “in the foreseeable future”.

Since 1990, the Commission has approved 6,504 buyouts, 439 with remedies, while it rejected just 29.

March 14, 2019

Source: EURACTIV

Source: EURACTIV

Các tin khác

- Shrimp exports to major markets bounce back (22/04/2024)

- Vietnam becomes biggest rice supplier for Singapore (22/04/2024)

- Vietnam proposes removal of quota on shrimp export to RoK (22/04/2024)

- Early warnings reduce risks in trade defense (22/04/2024)

- Rubber exports are flourishing, promising potential (22/04/2024)

Home

Home

About Us

About Us